Average tax return for single

Based on our estimates using the 2017 tax brackets a single person making 30000 per year will get a refund of. The average tax refund also varies.

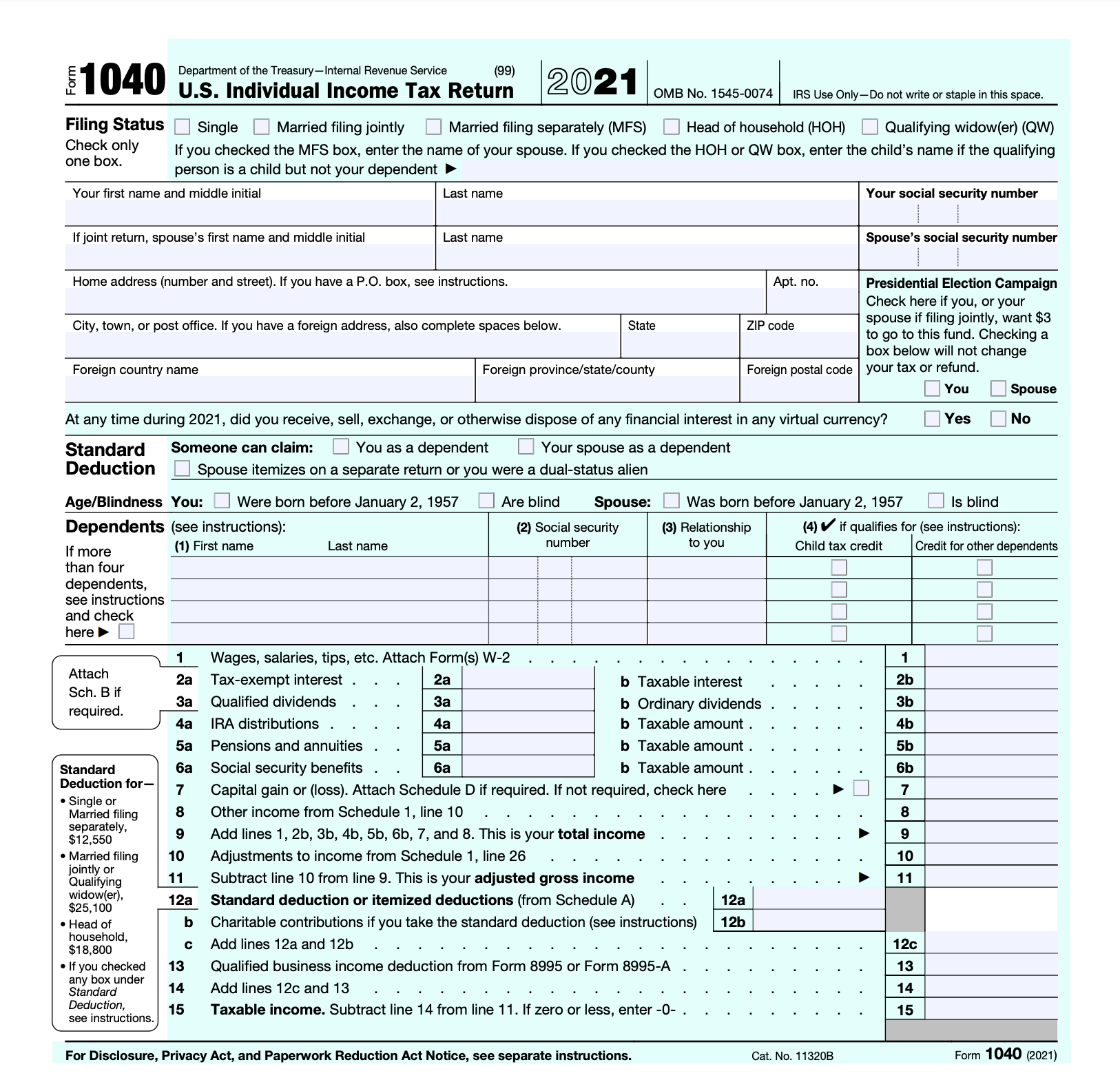

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

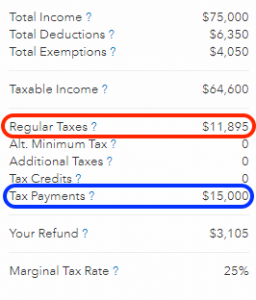

What is the average tax return for a single person making 65000.

. US Tax Calculator and alter the settings to match your tax return in 2022. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Heres a look at the average tax refund issued by state for 2019 fiscal year listed from highest average refund amount to lowest.

Based on our estimates using the 2017 tax brackets a single person making 30000 per year will get a refund of 1556. This is based on the standard deduction of 6350. You would claim the single filing status on your tax return if youre considered.

Depends on your income and whether you have things like uni debt. Whats the average tax return for a single person 2020. The average tax return for the 2020 tax year was 2827 a 1324 percent increase from the previous year.

According to the IRS in Fiscal Year 2016 the average individual income tax refund was about 3050Note that this does not include refunds in categories such as business. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Free And Easy Tax Estimator Tool For Any Tax Form.

If you make 65000 a year living in the region of California. Calculate your tax refund and file your federal taxes for free. I get about 1200 back from tax and my partner gets 2000ish even though Im the higher earner and pay a shitload of tax.

See What Credits and Deductions Apply to You. What is the average tax refund for a single person making 30000. For tax years from 2018 through 2020 a single mom filing as head of household and making less than 75000 as of publication can claim a 1000 child tax credit for each.

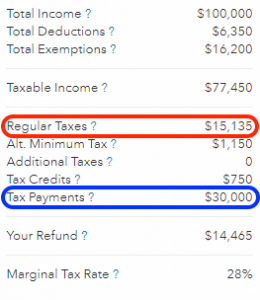

Well the average tax refund is about 2781 According to Credit Karma. In the United States the average single worker faced a net average tax rate of 224 in 2020 compared with the OECD average of 248. Ad Enter Your Tax Information.

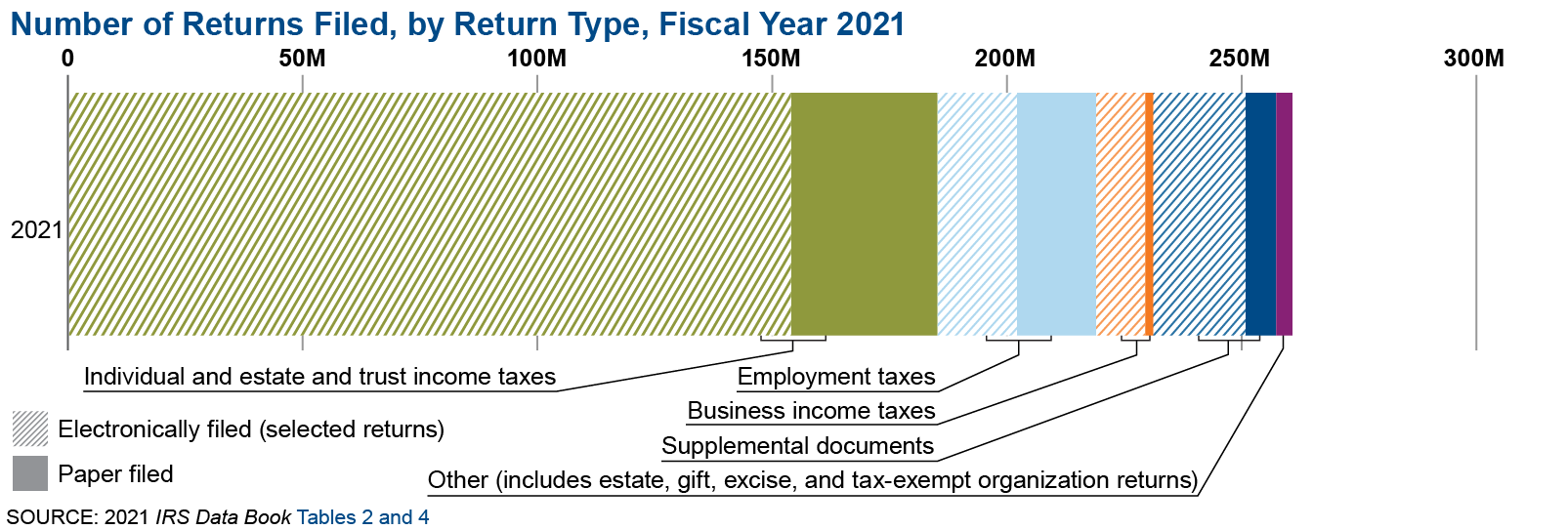

See How Easy It Really Is. What is the average tax refund for a single person making 30000. Nearly 2402 million returns.

Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. File Your 1040 Tax Return Online. For the 2020 filing season which covers returns filed for the 2019 calendar year the average federal tax refund for individuals was 2707.

Based on our estimates using the 2017 tax brackets a single person making 30000 per year will get a. Your average tax rate is 228 and your marginal tax rate is 396. Your marital status is defined by your status on the last day of the tax year December 31.

Average Tax Refund by State. But average doesnt mean guaranteed. What is the average tax rate.

So expect around three grand for your tax refund. This 40k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables.

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao

Pin On Ingenious Infographics

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Irs Form 433 B Oic Collection Information Statement For Businesses Visit Our Website To Download The Rest Of The Form Htt Irs Forms Sole Proprietorship Irs

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Do You Need To File A Tax Return In 2022 Forbes Advisor

Average Tax Refund May Surprise You

Our Clients Have A Clear Advantage Because They Use Our Automatic Business Expense Mileage Tracker Simplif Tax Deadline Income Tax Preparation Tax Deductions

Tax Schedule

What Was Your Income Tax For 2019 Federal Student Aid

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Was Your Adjusted Gross Income For 2019 Federal Student Aid